No Hidden Fees, No Monthly Fees, No Balance Requirements - More in Your Wallet

When you choose United Financial Bank's Savings Account, you can enjoy saving without worrying about hidden fees, monthly charges, or minimum balance requirements. It's straightforward, honest banking designed to help you achieve your financial goals.

Learn More

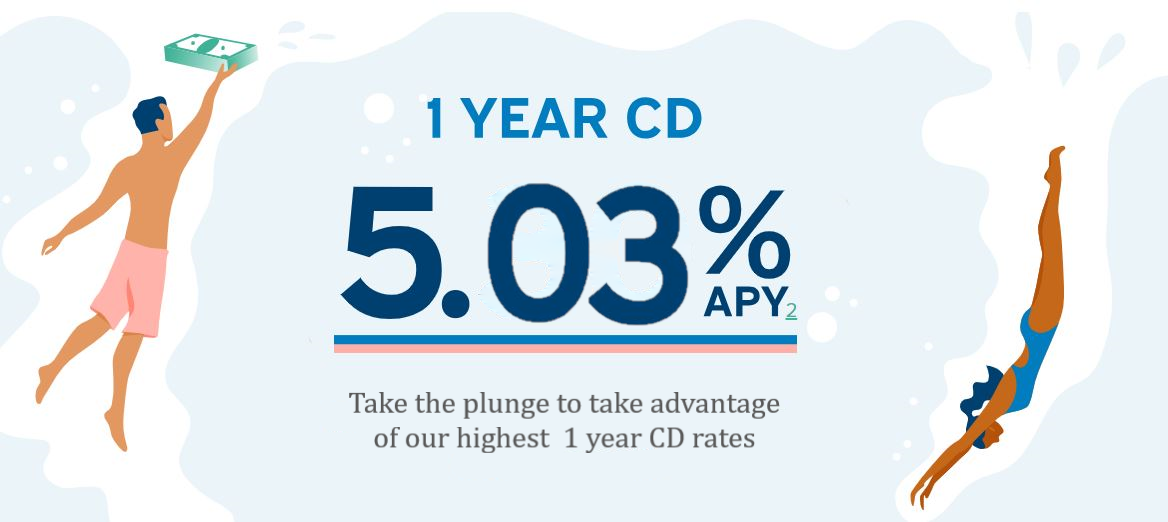

Grow Your Savings with Our 1-Year CD

Lock in a 5.03% Annual Percentage Yield (APY) with our 1-year Certificate of Deposit (CD). It's a secure way to watch your money grow over the next year. Open yours today!

Learn MoreBanking Made Simple with Our Mobile App

Our mobile app offers easy and secure access to your accounts, allowing you to manage your finances effortlessly from your smartphone, anytime, anywhere.

Learn More

Your Security, Our Priority

Rest easy knowing your finances are protected with our mobile app. We employ top-notch security measures including PINs, passwords, and biometric authentication options like Face ID to safeguard your account and ensure secure access.

Learn MoreFrequently Asked Questions

How do I open a United Financial Savings Account?

To open a United Financial Savings Account, you can visit our website and fill out the online application or visit any of our branch locations. Our friendly staff will guide you through the process.

Is there a minimum balance requirement for this account?

No, there is no minimum balance requirement for a United Financial Savings Account. You can start saving with any amount that suits your budget.

What is the interest rate on the Savings Account?

Our interest rates may vary from time to time, but we offer competitive rates that help your savings grow. You can check the current rates on our website or contact our customer support for the latest information.

Can I access my Savings Account online?

Yes, you can access your Savings Account online through our secure online banking portal. Manage your account, view transactions, and set up automatic transfers for added convenience.

Are there any fees associated with this account?

At United Financial Bank, we're proud to offer fee-free banking. We don't charge any fees for our Savings Account. Enjoy hassle-free saving without worrying about hidden charges. For more details, feel free to contact our customer service.

Can I set up automatic transfers to my Savings Account?

Absolutely! Setting up automatic transfers is a great way to ensure regular contributions to your savings. You can schedule transfers from your United Financial checking account or from an external bank account.